Explain Different Types of Currency Swaps

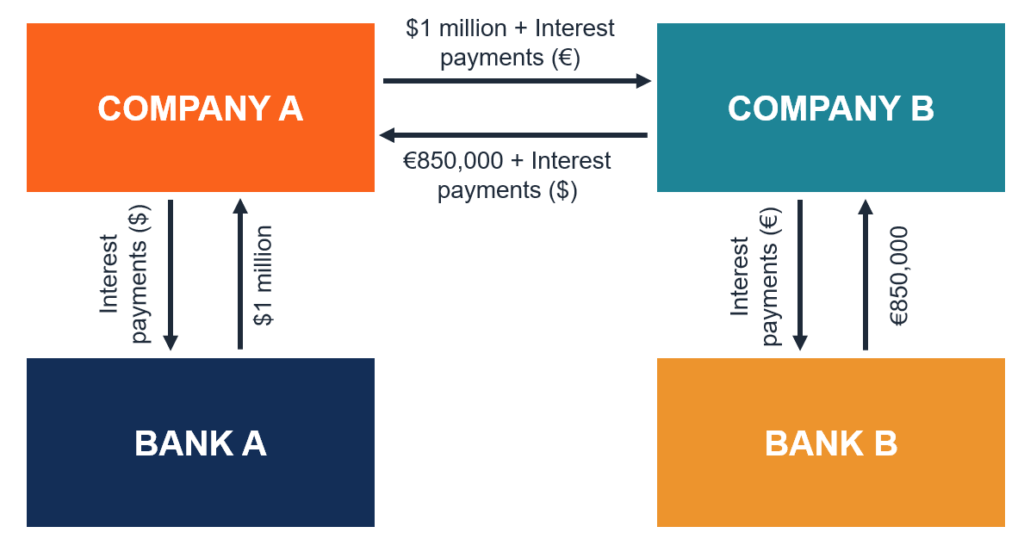

A spot exchange of principal this forms part of the swap agreement as a similar effect can be obtained by using the spot foreign exchange. In a currency swap or FX swap the counter-parties exchange given amounts in the two currencies.

Currency Swap Contract Definition How It Works Types

A currency swap is a derivative contract between two parties also known as counter-parties.

. A Plain Vanilla Swap. Currency swaps allow their holders to swap financial flows associated with two different currencies. This is the simplest form of Interest rate swaps where a fixed rate is exchanged for a floating.

In the first case two companies exchange principal. Fixed v Floating Cross-Currency Swaps. Hybrid swaps allow their holders to swap financial flows associated with different.

Cross currency swaps are agreements between counter-parties to exchange interest and principal. In an interest rate swap usually there is an exchange of a fixed interest rate for a floating rate or vice versa to either reduce or increase the exposure to fluctuations in interest rates or to. Currency Swap Contract Currency Swap Contract A currency swap contract also known as a cross-currency swap contract is a derivative contract between two parties that involves the.

Companies doing business abroad. Fixed-floating currency swap - A fixed-floating swap refers to a contractual arrangement between two parties in which one of the parties swaps the interest cash flows of. In a floating to floating swap.

In this form one leg of currency swap represents a stream of fixed-rate interest payments in one currency and are. Exchange of principal and exchange of interest. Types of Cross Currency Swaps There are two main types of cross-currency swaps.

A currency swap involves the exchange of interestand sometimes of principalin one currency for the same in another currency. Types of Currency Swaps Contract. Attempt any 5 questions.

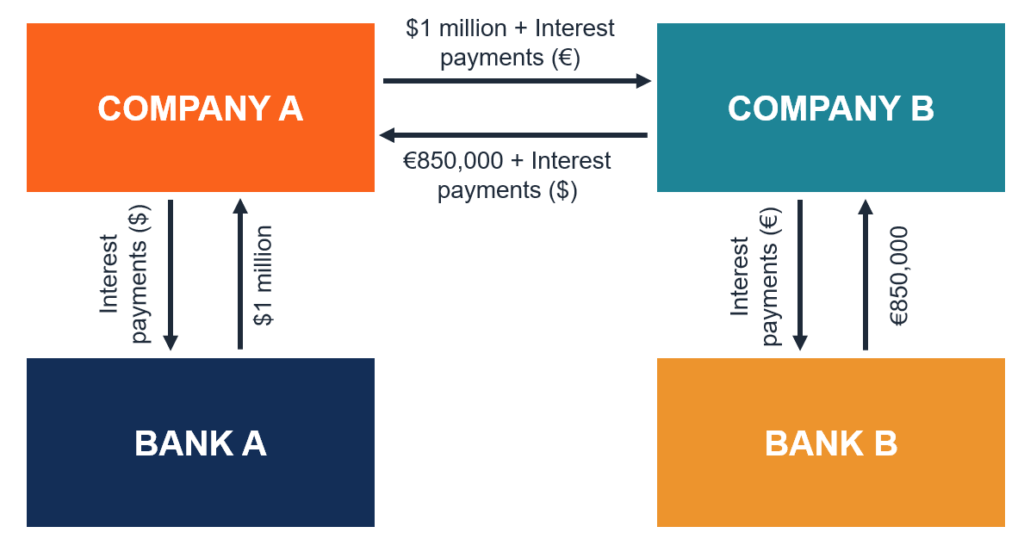

One leg of the currency swap represents a stream of fixed interest rate. What is currency Swap Classify the different types of currency rate Swaps Total Marks 80. They are a commodity currency volatility debt credit default puttable swaptions Interest rate.

There are several types of Swaps transacted in the financial world. Types of Swaps in Finance. The most commonly encountered types of currency swaps include the following.

Q1 a There are so. Are a common customization of the benchmark product often synthesized or hedged by market-makers by trading a float v float XCS and a standard. 2 Currency swap Currency Swap Contract A.

A currency swap can consist of three stages. Short-dated foreign exchange swaps include overnight tom-next spot-next and spot-week Foreign exchange swaps and cross currency swaps differ in interest payments. Different Types of Swaps 1.

For example one party might receive 100 million British pounds GBP while. Make suitable assumptions wherever necessary. It involves an exchange of principal and interest in one currency for the same.

There are two main types of. Types of Swaps 1 Interest rate swap Interest Rate Swap An interest rate swap is a derivative contract through which two counterparties. Key Takeaways A foreign currency swap is an agreement to exchange currency between two foreign parties in which they swap principal.

In finance a currency swap also known as cross-currency swap is a legal contract between two parties to exchange two currencies at a later date but at a.

:max_bytes(150000):strip_icc()/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

No comments for "Explain Different Types of Currency Swaps"

Post a Comment